Bitcoin has been setting new records regularly as investors hope that Trump will bring about a golden age of cryptocurrency, complete with more pro-business regulations and a possible national strategic bitcoin reserve or stockpile.

A surge in funding rates and open interest on the futures market precipitated this most recent action, putting the pioneer crypto asset within the $100K level on Friday.

The Bullish Debate

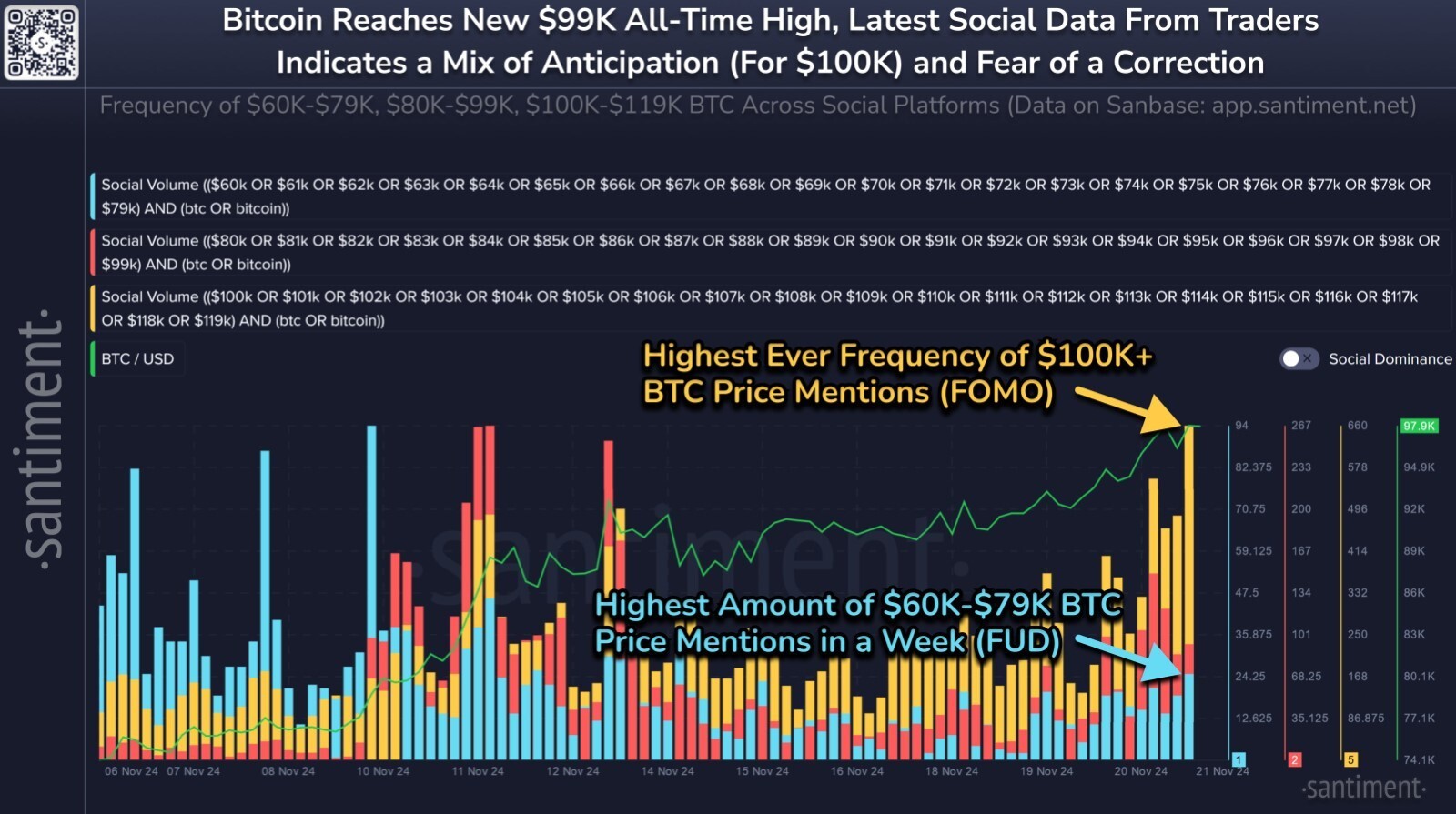

Social media speculation has exploded as Santiment data revealed that Bitcoin is poised to reach a six-figure market value for the first time in history, currently standing at a new all-time high of $99K.

Together, X, Reddit, Telegram, 4Chan, and BitcoinTalk are bringing up the $100K BTC price level at the fastest rate ever (naturally).

- However, this might be fueled by traders’ lack of confidence in this rally, as evidenced by unusually high mentions of lower price levels. Thank your fellow bears and non-believers for continuing this historic run, as the cryptocurrency markets move against the expectations of the majority.

- Data from CryptoQuant indicates that premiums in spot markets decreased around the same period. A surge of short liquidations, totaling over $120 million in a single day at one point, was also sparked by Bitcoin’s recent increases, which caused the price to rise overnight, according to CoinGlass.

- A few years ago, the $100K symbolic threshold might have seemed unattainable, but markets are now certain that it will happen soon because of its architecture’s features (a maximum of 21 million units and lack of a central authority to regulate it) and the appeal it has strengthened among traditional financial institutions like BlackRock and Goldman Sachs.

- U.S. President-elect Trump made a remarkable comeback during the campaign, despite being categorized as “anti-crypto,” primarily because he was aware of the growing number of users and their voting rights. Additionally, the U.S. cryptocurrency market contributed the most to his campaign funding.

The campaign cost cryptocurrency companies like Coinbase more than $130 million. Trump’s term also suggests higher budget deficits, possibly higher inflation, and adjustments to the dollar’s global role—all of which would boost the price of Bitcoin.

The Bearish Argument

Bitcoin reaching $100,000 in the next few minutes appears more like a short-term end-of-rally goal than a turning point that would instantly push the asset to a much higher level. Although it is impossible to predict with certainty whether the digital asset will remain above the $100,000 mark for an extended period, we can assume that a correction towards the $75,000/$80,000 range would then be reasonable, especially in a market environment where the dollar has strengthened (+7 percent for the Dollar Index since the beginning of October), and headline interest rates have experienced a powerful rise (more than 90 basis points in two months).

- Rates and the dollar are recovering at a time when investors are unsure of how quickly the Fed will cut rates following Donald Trump’s election, and when the most recent price indices released in the U.S. demonstrate resilience, including the PPI (producer price index) and the CPI (consumer price index), not to mention the surprising increase in import prices last month. Jerome Powell’s most recent remarks affirmed that the Fed is not in a rush to cut interest rates.

- Several campaign pledges are anticipated to be fulfilled following his election, including establishing a national bitcoin reserve, providing a regulatory environment that is advantageous to businesses operating in the space, and appointing a pro-crypto individual to lead the SEC (the U.S. financial regulator). According to press rumors, the White House is considering hiring a crypto specialist. All of this helps the industry as a whole flourish.

- The cryptocurrency market has demonstrated its sensitivity to U.S. monetary policy, especially in 2022. Therefore, it is reasonable to ask whether Bitcoin will correct at this time. Technically speaking, this might occur if the old oblique makes contact again during the April and October 2021 peaks.

A price correction in that direction is likely in play. A stronger “pullback” might also push prices back toward the previous high of roughly $74,000 in March 2024. However, historical data has shown that Bitcoin is popularly known for disappointing skeptics and maintaining its bullish momentum.