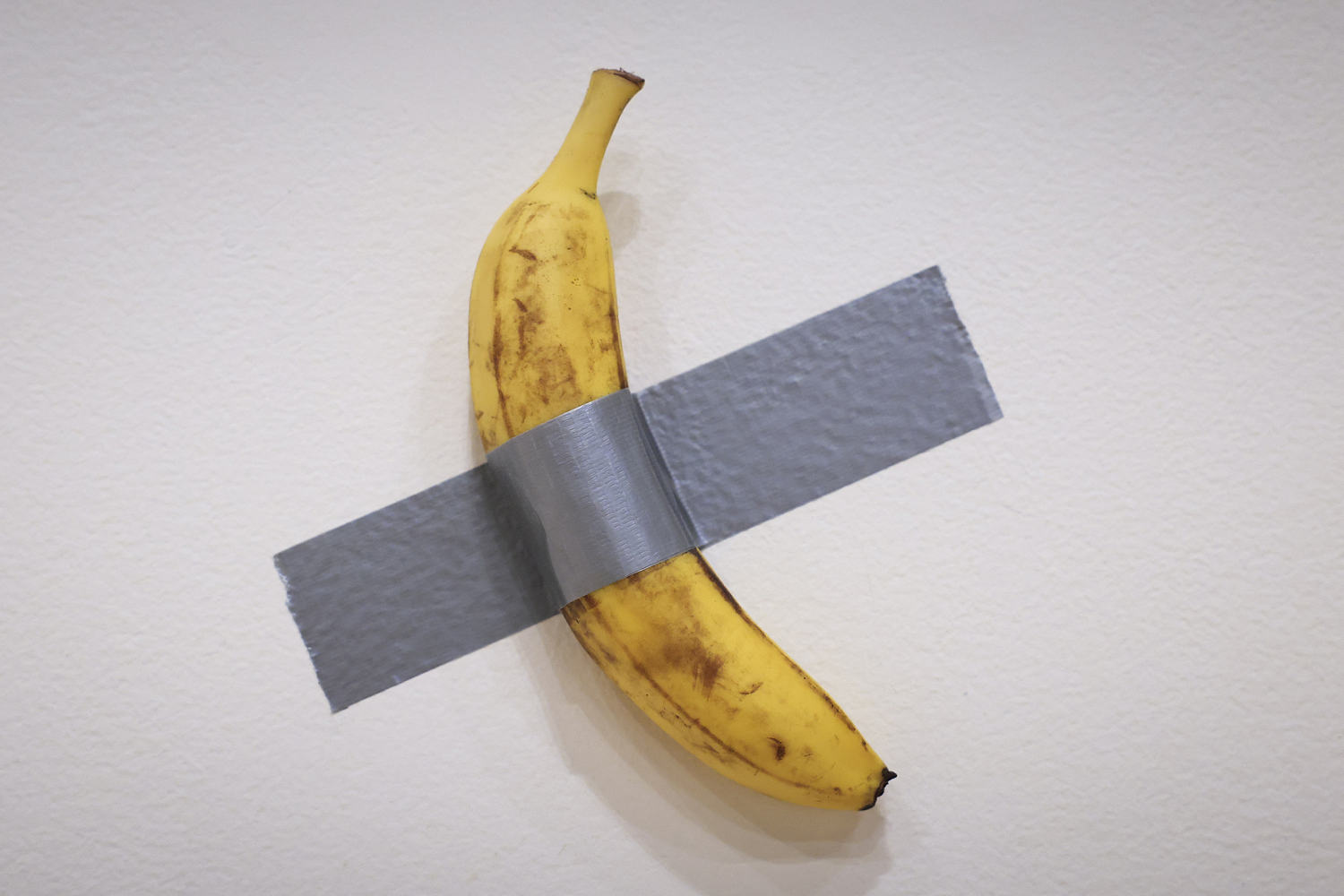

For most art-world buyers, a work unsubtly called “Comedian” lacked a certain a-peel.

It’s little wonder: “Comedian” is actually just a banana duct-taped to a wall. Created by Italian artist Maurizio Cattelan, the piece debuted at the 2019 Art Basel fair in Miami, where it caused a sensation but also earned as many chuckles as critical plaudits.

But on Wednesday, Cattelan got the last laugh as “Comedian” sold for $6.24 million, including $1 million in fees.

The buyer was soon revealed to be Justin Sun, a 34-year old cryptocurrency platform founder from China and based in Switzerland. Sun confirmed the purchase on his X feed, writing that it represented “a cultural phenomenon that bridges the worlds of art, memes, and the cryptocurrency community.”

“I believe this piece will inspire more thought and discussion in the future and will become a part of history,” Sun wrote, adding he would personally eat the banana “as part of this unique artistic experience, honoring its place in both art history and popular culture.”

A Sotheby’s executive, meanwhile, hailed the purchase as emblematic of someone seeking to address art’s biggest questions.

“How do you value what, for me at least, is one of the most brilliant ideas in the history of conceptual art,” David Galperin, Sotheby’s head of contemporary art for the Americas, said in a release. “And what better place to ask that question than in our salesroom, where tonight the answer came in at a resounding $6.2 million.”

Yet in much of the broader art world, Sun’s winning bid was met with a shrug. Continuing a recent trend, 2024 has seen some of the worst sales in decades, and the purchase of “Comedian” is unlikely to move the needle one way or the other, said Alex Glauber, founder of AWG Art Advisory and president of the Association of Professional Art Advisors.

“I don’t think it’s an indication of anything,” Glauber said of the “Comedian” sale. He compared it to the purchase in 2017 of Leonardo da Vinci’s “Salvatore Mundi” for a then-record $450 million, which occurred at a time when the demand for “old masters,” or classic, traditional artworks, was waning in favor of contemporary works.

Likewise, “Comedian” is being considered something of a one-off, Glauber said. While $6.24 million might seem like an eye-watering price for such a work, its very absurdity goes hand-in-hand with the nature of the piece and does not necessarily speak to wider purchasing trends.

“It’s about holding a mirror up to the art market, while channeling a legacy of conceptual art going back to Duchamp,” Glauber said, referring to artist Marcel Duchamp, whose submission of a urinal he dubbed “Fountain” to an art exhibition in 1917 is considered a foundational moment in conceptual art.

“So in a way this work is self-reflexive — and the more it sold for, the more it proved its own concept.”

The rest of Sotheby’s Wednesday auction is arguably more indicative of the art market’s doldrums: Sotheby’s “Now” portion of the evening, which showcases art produced in the last 20 years, saw $16.5 million in total sales, beating estimates but coming in far below the $72.9 million seen for the equivalent “Now” auction in 2022, according to The New York Times.

In a recent paper, Jianping Mei and Michael Moses of JP Mei & MA Moses Art Market Consultancy found that the average return on art sold in the first of half 2024 was just 0.1%, the lowest yield since 2000 — with half the works selling at a loss.

“How bad is it? It’s as bad as it gets,” Moses told NBC News. “It’s been a difficult period for the art market.”

One big reason is simply that other investments, like stocks and gold, have seen far greater returns this century, Moses said.

And while some who have capitalized on those assets will inevitably purchase art, artworks themselves have their own rates of return that depend more on evolutions in taste that don’t correlate with wider macroeconomic trends.

What “Comedian” may signal instead is an expansion of the kinds of goods that cryptocurrencies can buy, as those financial instruments continue to witness stunning price increases. This year, the price of bitcoin has more than doubled, and is now approaching $100,000.

Sun, the “Comedian” buyer, used his own cryptocurrency, TRX, to make the purchase, Sotheby’s said. According to CoinMarketCap, the market value of all outstanding TRX coins as the sale occurred equated to more than $12 billion, with Sun himself boasting a net worth of $1.5 billion.

According to the Robb Report, cryptocurrency use in high-end purchases for everything from real estate to yachts to jewelry has increased in turn.

Yet even those purchases may not represent the norm. Robert Allen, a South Florida-based attorney who specializes in yacht deals, said people who are newly wealthy from cryptocurrency price increases appear to be prioritizing financial goals that were once previously attainable but which several years of soaring consumer prices and high interest rates have made more difficult.

“Inflation has taken the American dream away from millennials and younger generations,” he said. “But for a certain sector that has invested in crypto, when it makes a hit, they’re making down payments on houses, maybe taking a trip to Europe or around South America. I don’t think there’s going to be an explosion in high-end luxury yet.”